Q2: Platinum strikes gold amid market volatility

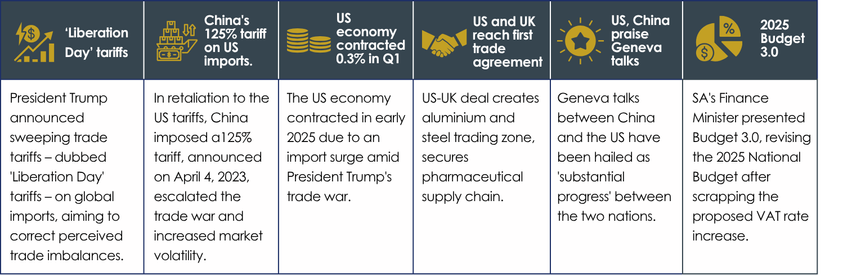

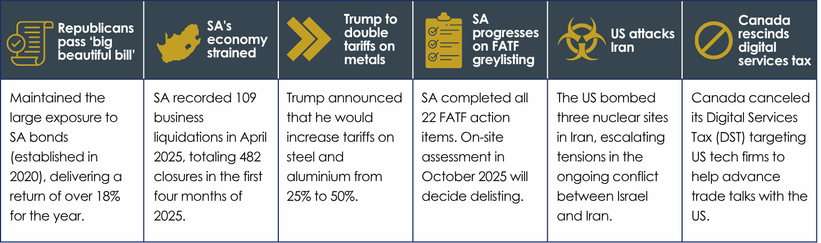

The second quarter was marked by significant market volatility, fuelled by renewed trade tensions, growing fears of a global economic slowdown, and shifting investor sentiment. These pressures led to sharp sell-offs—particularly in tech stocks—and a spike in trading activity, which further magnified market swings. Despite the volatility we witnessed the JSE ALSI advancing by over 10% for the period.

Gold briefly topped $3,500/oz before retreating

In April, gold hit a record $3,500/oz before easing. A VAT hike was avoided, and the rand weakened 1.5% against the dollar. Global markets were mixed. The S&P 500 dipped 0.7% amid trade and political concerns whilst European and UK equities declined as inflation slowed. Emerging markets, led by Latin America, outperformed, while China lagged due to renewed US-China tensions.

JSE rose 3%, Gold miners fell

In May, the JSE All Share Index added 3%, though gold miners pulled back. SA bonds rallied on positive global momentum and a well-received budget. The rand strengthened 3.3%, and the SARB cut rates by 25bps as inflation eased to 3%. Globally, sentiment improved on news of a US-China tariff deal. The MSCI World Index and S&P 500 each rose 6%. Euro stocks rebounded and emerging markets gained 4.3% on dollar weakness.

Inflation in South Africa stayed under 3%

South Africa’s inflation in June remained below 3%. Platinum stocks surged while the JSE All Share Index added over 2%, with property the only laggard. Tech led gains in the US (Nasdaq +6%) and Chinese shares rose on stimulus hopes. There were renewed geopolitical tensions, including US-China trade strains and strikes on Iranian nuclear sites. However, markets rebounded as China eased rare earth export restrictions and global trade fears eased. The MSCI World Index rose 4.3% in USD.

From the pitch to your portfolio: Winning the long game

On 14 June 2025, South Africans celebrated more than just a cricket victory. The Proteas, after decades of heartbreak and near-misses, lifted the ICC World Test Championship trophy - their first ICC title since 1998. It was a moment of national pride, but also one that demonstrated the power of patience, resilience, and trust in a long-term plan.

Test cricket is the ultimate long game. It demands discipline, composure, and the ability to adapt through changing conditions - much like the path to long-term investment success.

Investing for retirement is about more than reacting to every delivery or market move. It is about building your innings over time, remaining calm under pressure, and trusting in the fundamentals. Just as the Proteas relied on a balanced and adaptable squad, strong portfolios rely on a carefully selected team of asset managers - each playing their role to deliver consistent, long-term outcomes.

Continuing to strengthen our approach, we are pleased to announce the inclusion of 36ONE Asset Management within the Destiny Portfolio’s local equity strategy.

A new strategic partner

36ONE is one of South Africa’s leading asset managers, with over R60 billion in assets under management and a track record of more than 15 years of strong, risk-adjusted returns. Their high-conviction, actively managed approach is backed by deep fundamental research and a nimble investment process - qualities we believe are essential in today’s increasingly complex and fast-changing market environment.

Their inclusion brings meaningful diversification to our manager blend. The GIB Investment Committee has been seeking a complementary manager to strengthen the local equity building block - one that offers consistent outperformance, disciplined risk management, and the ability to adapt quickly to changing conditions.

Looking ahead

As part of our continued commitment to enhancing and aligning our portfolios, we stay focused on our long-term objectives: fostering growth, managing risk, and achieving improved retirement outcomes for our members.

Just like test cricket, long-term investment growth takes time, strategy, and a trusted team. With our lineup, we believe that the Destiny Portfolios are well placed to continue delivering consistent performance and to keep playing the long game, with conviction.

We grow your wealth by combining active and passive management in an innovative matrix. GIB has been able to continues to deliver while reducing costs and increasing efficiency. Grow you wealth today

Learn more